MULTIPLE PROTECTION

01 Auto – Lot

Auto-Lot, already known as the compound interest effect, is also an optimal protection against large losses.

If the balance were reduced due to a loss or payout, the lot number would also be adjusted downwards for the next trading days. This also ensures that a margin call cannot occur.

02 Trailing Take Profit

If the trigger take profit is reached, a trailing stop is triggered to secure profits if the price rises and only closes when a defined decline occurs.

If the trailing take profit is not reached and the price goes in the negative direction, the defined stop loss is triggered.

MULTIPLE PROTECTION

03 Time To Close

Time-To-Close is the horizontal protection if the price only goes sideways and the basic program with take profit cannot close, a close-all is triggered after 70 minutes.

MULTIPLE PROTECTION

04 Vertical protection

Vertical protection is the last protection if everything else fails and thus protects against total loss!

If the price turns against the hedge, it is closed by a defined stop loss and a new opposite hedge is opened.

This happens until a trailing take profit is reached, thereby triggering a close all.

MULTIPLE PROTECTION

05 Maximum Hedges To Close

The maximum number of hedging positions that an investor or entity wishes to liquidate or close out. Hedging is a risk management strategy that involves taking offsetting positions to reduce the impact of adverse price movements in an asset. When an investor or entity decides to close out or liquidate their hedging positions, it means they are removing the protective measures put in place to mitigate risk. The decision to close hedges may be influenced by various factors such as changes in market conditions, the cost of the hedge, or a reassessment of risk exposure. It’s important for investors to carefully consider the implications of closing hedges, as it can impact their overall risk profile and financial outcomes.

MULTIPLE PROTECTION

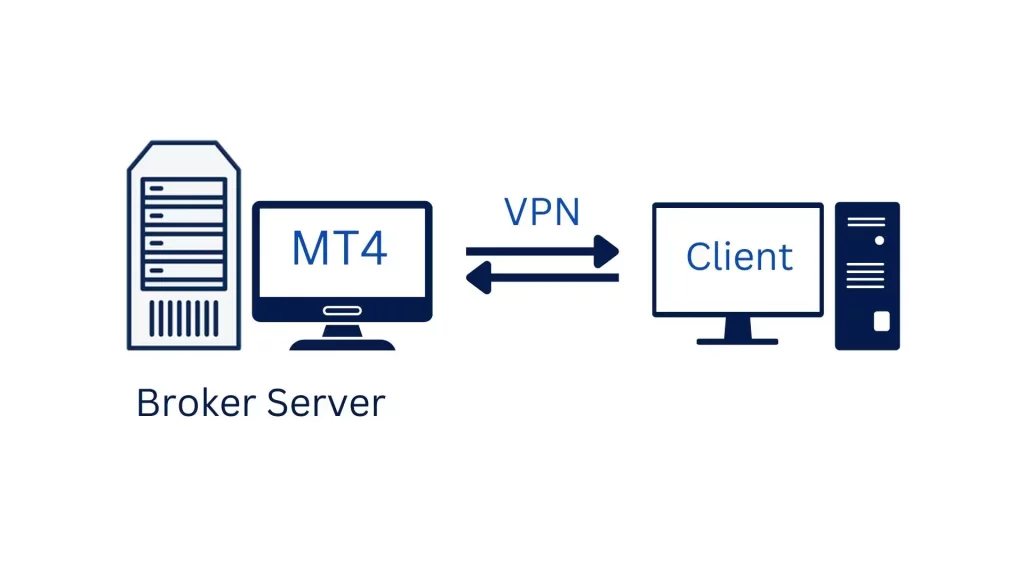

06 VPN Access To Broker Server

IM TRADER IS RUNNING ON THUNDER BROKER SERVERS

A VPN client is a software application that allows a user to connect to a VPN server for secure and private access to the internet. In the context of trading, a IM TRADER is running on THUNDER broker’s server in a secure manner, ensuring that their trading activities are encrypted and their data is protected from unauthorized access. This can be particularly useful when accessing region-specific broker websites or when trading crypto, where security is of utmost importance. However, it’s important to choose a reliable, premium VPN service to avoid potential risks such as data leaks, malware, and annoying ads