Basic Program

describes a form of program trading, which involves the use of computer-generated algorithms to trade a basket of stocks in large volumes and with high frequency.

The program, in our case IM TRADER, is designed to trade at Dow Jones and DAX40 during the broker’s available time, typically 23 hours a day from Monday to Friday. It executes sell and buy orders simultaneously and continues to open and close orders based on price movements until a defined take profit is reached.

Program trading is often used by large investors, fund houses, and hedge funds to efficiently and effectively trade based on predetermined strategies. Program trading typically requires a high volume of trades to be executed according to predetermined rules and is designed to exploit market inefficiencies and multiple securities opportunities. It involves the electronic execution of a set of trades based on predetermined rules, which can involve the simultaneous buying or selling of multiple securities

What is the difference between sell and buy orders in the Basic Program of IM TRADER?

In the “Basic Program” of IM TRADER, the difference between sell and buy orders lies in their respective actions. A buy order is an instruction to purchase a security, while a sell order is an instruction to sell a security. In the context of trading, a buy order is executed when the trader anticipates the price of the asset to rise, and a sell order is executed when the trader anticipates the price of the asset to fall. Buy orders are typically placed at or below the current market ask price, while sell orders are placed at or above the current market bid price. When these orders are executed, they contribute to the opening and closing of positions based on the program’s trading strategy.

What is the Dow Jones?

The Dow Jones, often referred to as the Dow Jones Industrial Average (DJIA), is a stock market index that measures the stock performance of 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ. It provides a snapshot of how the stock market is performing. The index is price-weighted, which means that stocks with higher prices have more influence on the index’s value. The Dow Jones is one of the most widely followed stock market indices and is used as an indicator of the overall health of the stock market and the broader economy.

The Dow Jones Industrial Average is calculated by adding the stock prices of the 30 component companies and dividing the sum by a divisor that is adjusted to account for stock splits, dividends, and other corporate actions. The index is quoted in points, not dollars. Changes in the DJIA are widely reported in financial news media and can have an impact on investor sentiment and market movements.

What is the DAX 40?

The DAX 40 is a stock market index that includes the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a key indicator of the German stock market and is used to reflect the performance of the country’s most significant and actively traded stocks. The DAX 40 is calculated using the prices of the 40 component stocks and is weighted by market capitalization. This means that larger companies have a greater impact on the index’s value. The DAX 40 is an important benchmark for investors and provides insights into the overall health and direction of the German economy.

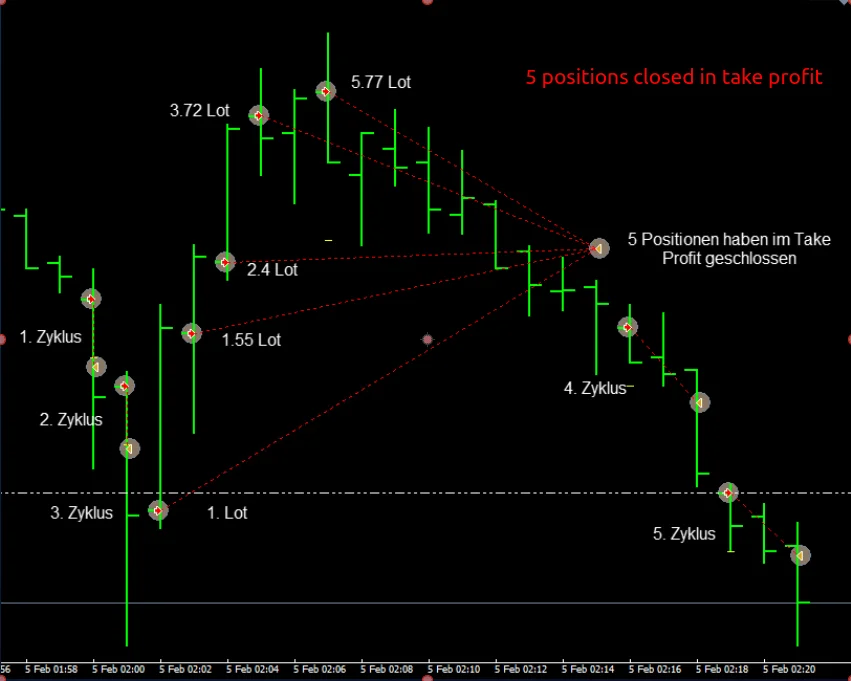

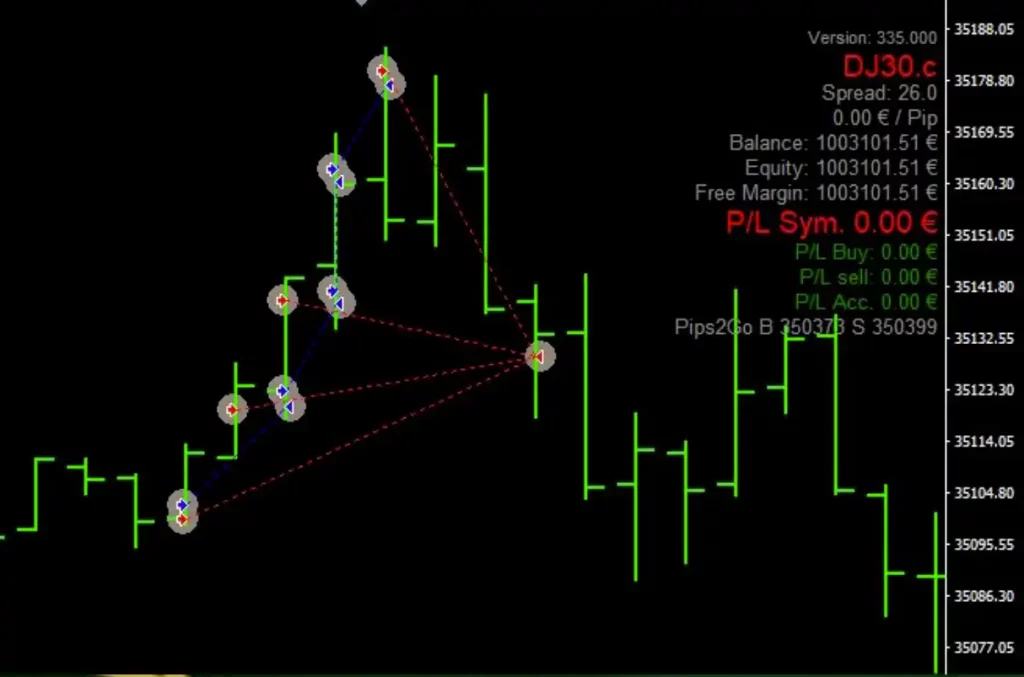

Functionality Example

This is an example of sell cycles. In the same way, Buy’s work in opposite directions parallel to each other!

DJ and DAX cycles are started at different times. This is how we use the different periods of volatility to increase your trading profits.

Starting from a 100,000 deposit, each cycle starts with 1 lot, taking the compound interest effect into account and increases by 1.55 times for each additional position.

A maximum of 9 positions are possible and then hedging begins!

A new cycle begins when the previous cycle in Take Profit is closed or hedging is started.