INTELLIGENT HEDGING 1

In some cases the basic program does not achieve the take profit and would not close.

This is where intelligent hedging begins. Depending on the price development, a buy or sell hedge is opened.

The situation in trading, where the basic program fails to achieve the intended profit and close a position, the concept of intelligent hedging is introduced as a potential solution. Intelligent hedging involves the strategic opening of buy or sell hedges based on the price development of the asset being traded. When a basic trading program is unable to reach the take profit level and close a position, traders may turn to intelligent hedging strategies to manage the situation. This approach takes into account the evolving price dynamics of the asset and seeks to make strategic decisions about opening buy or sell hedges to offset potential losses and better control risk. Intelligent hedging, therefore, represents a more dynamic and adaptive approach to managing trading positions, especially when initial strategies do not yield the expected results. By incorporating an understanding of market movements and using this information to inform hedging decisions, IM TRADER aim to navigate challenging scenarios more effectively.

INTELLIGENT HEDGING 2

If the price turns against the hedge, it is closed by a defined stop loss and a new opposite hedge is opened.

This happens until a trailing take profit is reached, thereby triggering a close all.

INTELLIGENT HEDGING 3

The lot number for this hedge is formed from the sum of all open positions in the cycle.

For a 100,000 euro account, that’s 92.5 lots

INTELLIGENT HEDGING 4

If the hedge is opened after reaching the next grid size, a stop loss is immediately set. This must be below the current price value so that it does not trigger immediately.

This is the adjustable delta, which is between 10 and 15 chart points so that the stop loss can withstand smaller price fluctuations and does not trigger immediately.

INTELLIGENT HEDGING 5

If the price continues to rise, the stop loss will also move at the same distance until the stop loss no longer incurs losses when triggered.

Then the price goes down and closes the cycle in Take Profit.

In the meantime, a new, independent cycle is beginning again, as can be seen in the picture here..

INTELLIGENT HEDGING 6

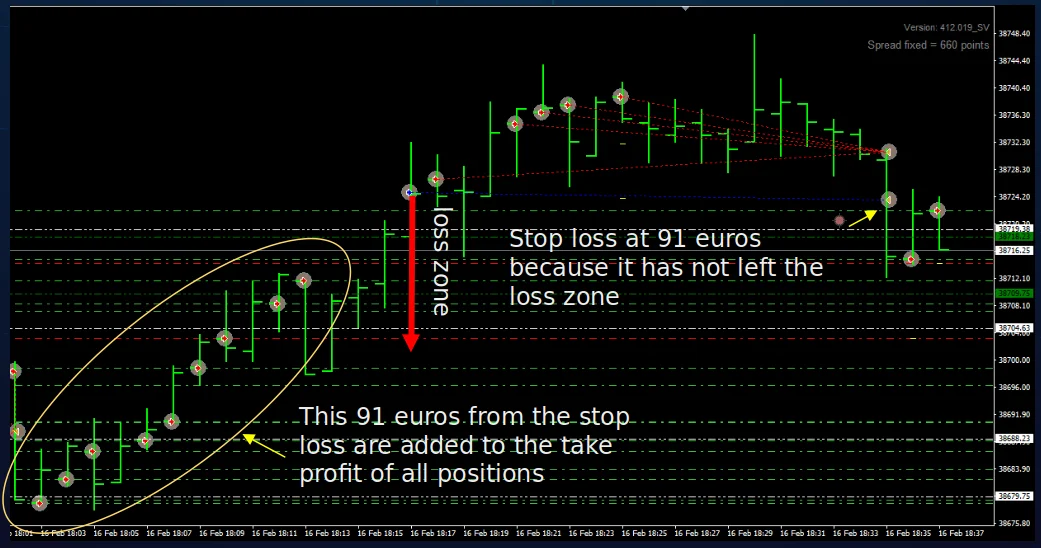

However, if the price turns before the stop loss comes out of the loss zone and this is triggered, the loss caused by the stop loss, in this example -91 euros, is included in the take profit of all positions in the cycle, so that when the take profit is reached the entire cycle closes in positive territory.